11 Tiger Global DoorDash Trades

Tiger Global's position in DoorDash is currently worth $286 Million. That's 1.73% of their equity portfolio (15th largest holding). The first DoorDash trade was made in Q4 2020. Since then Tiger Global bought shares seven more times and sold shares on three occasions. The stake costed the investor $186 Million, netting the investor a gain of 54% so far.

News about DoorDash Inc - Ordinary Shares - Class A and Tiger Global

Tiger Global takes new stakes in Alibaba, Doordash, exits DLocal in Q3

vm Chase Coleman''s Tiger Global Management started new positions in Alibaba (NYSE:BABA), with 1.48M shares, Doordash (NASDAQ:DASH), with 1.23M shares,…

DoorDash''s Global Ambitions Are Outpacing Rivals: Analyst

JMP Securities analyst Andrew Boone reiterated DoorDash Inc (NYSE: DASH ) with a Market Outperform and a $100 price target. After analyzing 3P app data and s...

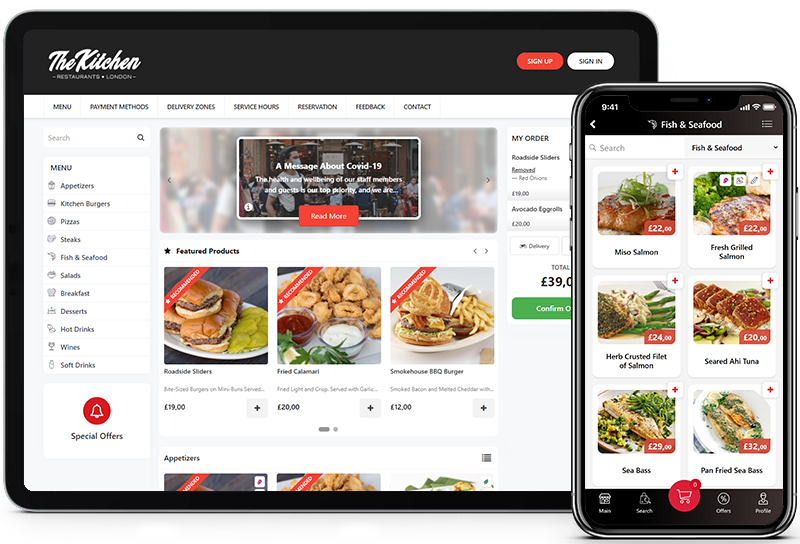

Restaurant Online Ordering System Market to See Competition Rise | Uber Eats, DoorDash, Zomato

Restaurant Online Ordering System Market to See Huge Demand by 2030 PUNE, MAHARASHTRA, INDIA, June 19, 2023 /EINPresswire.com/ -- According to HTF Market I...

Y-Combinator recognises Razorpay as the only Indian company to appear in Top 15 Breakthrough Global Companies List

Bengaluru (Karnataka) [India], March 3 (ANI/NewsVoir): Razorpay, India''s Leading Full-Stack Payments and Banking Platform for Businesses, has ranked #11 in ...